Massachusetts Congressman Barney Frank announced earlier this week that he will retire from Congress at the end of his present term and not seek re-election in 2012.

His official reason was related to the redistricting of Massachusetts Congressional Districts as mandated by the 2010 census and reflecting the loss of 1 seat in the House by the Commonwealth of Massachusetts. His new district was structured in such a way as to make a re-election effort by Frank far more challenging - and no longer a sure win for the caustic Representative.

Regardless of the 'real' reason for the decision to retire from Congress, Barney Frank leaves a legacy from his service that will affect the United States for decades to come. This legacy has virtually nothing to do with his sexual preference and being the first member of Congress to openly come out as a homosexual.

Franks' championship towards 'social justice' and altering marketplaces in order to provide for social justice / fairness by forcing banks and mortgage companies to lend to based not on financial grounds but on social engineering grounds. Far too few of the recipients of this social engineering had the fiscal means to afford the homes they were purchasing. Rather than loans being made, as asserted by Frank and others, by misrepresenting the terms of the loans and embarking on predatory lending, loans were made irresponsibly in the name of non-discrimination.

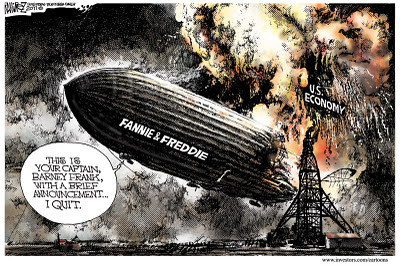

Key to the efforts towards 'fairness' and 'social justice' were the actions of Fannie Mae and Freddie Mac. Their role at the center of the US mortgage marketplace made these government sponsored enterprises (GSE) critical to promoting social engineering and enacting the progressive vision of the Community Reinvestment Act. Throughout the 1990's and into the 2000's, Barney Frank used his seniority and position in the House Financial Services Committee to deflect and prevent all efforts to impose regulatory controls, checks, and balances on these GSE's.

In 2003, as this video shows, Frank is emphatic that neither Fannie or Freddie were in any danger of insolvency from their efforts promoting social justice / engineering and that efforts to increase regulatory oversight were misplaced. Frank was not only wrong with his efforts, but incredibly wrong - substituting his ideological viewpoint over any responsible concern that the stage was being set for a major economic crisis. In fact, rather than being responsible, Frank pushed at this time for even more lending to be done to promote social justice.

"I would like to get Fannie and Freddie more deeply into low-income housing and possibly moving into something that is more explicitly a subsidy," said Frank. "... I want to roll the dice a little bit more in this situation towards subsidized housing." Moreover, Frank worried that critics of lower lending standards might create "pressure" which would, in turn, lead to "less ... affordable housing."

In January 2007, Frank became the Chairman of the House Financial Services Committee as the Democrats regained their majority in Congress. As early signs of a mortgage and banking industry crisis started appearing, directly as a result of these ill-advised lending practices, Frank not only continued to defend these practices, but worked to point the finger of blame at the lenders for 'taking advantage' of minorities. The goal was to continue advocating social justice regardless of the effects on the marketplace. Furthermore, any adverse results from this were not a result of the failures of social justice, but in the greed and racism of the 'system'.

As the depths of the economic crisis hit fully in 2008, precipitating a near total collapse of the banking system, Frank blamed the circumstances not on his policies and those of his fellow progressives, but on the GOP and the lack of effective regulations on the banks. The irony and the hypocrisy of Frank just a few years earlier working to block regulations on the GSE's seems to be lost to far too many.

Frank also continued to press for more ill-advised and destructive fiscal policies across a far larger stage - that of the US government's fiscal policy. His solution to the 2008 crisis?

"I think at this point there needs to be a focus on an immediate increase in spending, and I think this is a time when deficit fear has to take a second seat. I do think this is a time for a very important kind of dose of KeynesianismWhat we've seen since this point are the policies and ideological visions of Frank, President Obama, and other progressives - annual deficits of more than $1.4 trillion, adding $5 trillion to the national debt in just over 3 years, and continued poor economic results. He demands, as does the President, for more 'fairness' in taxing the rich while knowing full well that even the seizure of 95% of the total assets of the 'rich' cannot erase one full year's annual budget deficit let alone stop the run down the path to insolvency in the name of 'social justice'.

With Frank's departure, we lose one of the members of government who made some of the biggest contributions towards the crisis we are currently facing. We lose a caustic bully, an angry bitter person who is frustrated. While he should be frustrated with the fact that his political and ideological vision do not lead towards the utopia it should and instead led towards fiscal disaster - it's far more likely that Frank's frustration comes from the fact that he wasn't able to do more, faster, to get rid of a political and economic system that he despised...but personally enriched himself in.

History ultimately remembers very few of the very worst who come to Washington and cause such damage to the country. Barney Frank might be one of the exceptions to this 'rule' - particularly given the depth and cost his actions caused to all Americans. That will be his legacy.

Now if only Maxine Waters, Henry Waxman, Alcee Hastings, Sheila Jackson Lee, Lynn Wolsey, Barbara Lee, John Conyers, Pete Stark, and Jan Schakowsky would follow Frank's lead.

No comments:

Post a Comment